Man look at all the volume on the June 17.5 puts, and it was right at the end of the day. 7,184 contracts traded.

Something has to be up.

There are about 120,000 put contracts outstanding at-the-money and down to the 17.5 strike.

A Voluntary Contraction of the Credit Market resulting in the Involuntary Liquidation of Physical & Derivative Assets at a Material Loss Causing a Severe Recession or even possibly a systemic financial meltdown

Man look at all the volume on the June 17.5 puts, and it was right at the end of the day. 7,184 contracts traded.

Something has to be up.

Posted by

Editor

at

4:28 PM

View Comments

![]()

Jim Cramer made the following statement concerning Lehman Brothers:

It is time. It is time for Lehman to put up its defense. Not the talking one. But the one it used in 1998 when everyone thought it was a goner. It needs to go in and start buying its stock. Think about it. If Lehman is right and self-styled nemesis David Einhorn from Greenlight Capital is wrong about the firm needing capital, this has to be one of the greatest buying opportunities Richard Fuld, the CEO, has ever had. Not since 1998, when he bid me $31 for a million shares in order to take advantage of the endless raids that his firm had because of alleged problems in London, has Richard Fuld had such a great chance to make a statement.

But here's the flip side. Without such a vow and show of not just confidence but opportunity, the market is going to determine that Greenlight is right and the spiral will be endless. We know what happens when a company needs capital. You get a Washington Mutual(WM -Cramer's Take - Stockpickr), a Nat City(NCC - Cramer's Take -

Stockpickr), an AIG(AIG - Cramer's Take - Stockpickr) or worse, a Bear(BSC -Cramer's Take - Stockpickr).

Posted by

Editor

at

12:31 PM

View Comments

![]()

AS HOUSE prices in America continue their rapid descent, market-watchers are having to cast back ever further for gloomy comparisons. The latest S&P/Case-Shiller national house-price index, published this week, showed a slump of 14.1% in the year to the first quarter, the worst since the index began 20 years ago. Now Robert Shiller, an economist at Yale University and co-inventor of the index, has compiled a version that stretches back over a century. This shows that the latest fall in nominal prices is already much bigger than the 10.5% drop in 1932, the worst point of the Depression. And things are even worse than they look. In the deflationary 1930s house prices declined less in real terms. Today inflation is running at a brisk pace, so property prices have fallen by a staggering 18% in real terms over the past year.

Posted by

Editor

at

3:57 PM

View Comments

![]()

The debt markets in the US and Europe have begun to flash warning signals yet again, raising fears that the global credit crisis could be entering another turbulent phase.

The cost of insuring against default on the bonds of Lehman Brothers, Merrill Lynch and other big banks and brokerages has surged over the last two weeks, threatening to reach the stress levels seen before the Bear Stearns debacle. Spreads on inter-bank Libor and Euribor rates in Europe are back near record levels.

Credit default swaps (CDS) on Lehman debt have risen from around 130 in late April to 247, while Merrill debt has spiked to 196. [On May 23rd 2008 activity on Lehman out-of-the-money puts increased by 140,000 contracts alla Bear Stearns] Most analysts had thought the coast was clear for such broker dealers after the US Federal Reserve invoked an emergency clause in March to let them borrow directly from its lending window.

But there are now concerns that the Fed itself may be exhausting its $800bn (£399bn) stock of assets. It has swapped almost $300bn of 10-year Treasuries for questionable mortgage debt, and provided Term Auction Credit of $130bn.

"The steep rise in swap spreads this week is ominous," said John Hussman, head of the Hussman Funds. "The deterioration is in stark contrast to what investors have come to hope since March."

Lehman Brothers took writedowns of just $200m on its $6.5bn portfolio of sub-prime debt in the first quarter even though a quarter of the securities had "junk" ratings, typically worth a fraction of face value.

Willem Sels, a credit analyst at Dresdner Kleinwort, said the banks are beginning to face waves of defaults on credit cards, car loans, and now corporate loans. "We believe we're entering Phase II. The liquidity crisis has eased a little, but the real credit losses are accelerating. The worst is yet to come," he said.

Posted by

Editor

at

9:39 AM

View Comments

![]()

Speaking Wednesday [May 21] at the 13th Annual Ira W. Sohn Investment Research Conference in New York, Mr. Einhorn said he was short Lehman Brothers stock because he remains skeptical about Lehman’s accounting...

In a book published by Wiley to be released this month called Fooling Some of the People All of the Time: A Long Short Story, Mr. Einhorn gives a detailed narration of his multi-year clash with Allied. The book depicts the manager’s skepticism of the integrity of Wall Street, which he said is more eager to accuse short sellers of conspiring against corporations than it is to scrutinize companies’ financial statements. By making the case against Lehman, the fourth-biggest U.S. securities firm, Mr. Einhorn appears to be preparing to fight the same battle again only with a different and bigger opponent.

... the Lehman story is a sensitive one. In March, as Bear Stearns Cos. Inc. was slowly sinking under the double blow of short sellers and creditors’ pullouts, Lehman was rumored to be next.

But during an earnings conference call on March 18, a day after Lehman’s stock price fell 20% as a result of the Bear Stearns’ bailout announcement accompanied by negative rumors about Lehman, Erin Callan, chief financial officer at Lehman, stood up and answered analysts’ questions in a frank and straightforward fashion. ...

As a meticulous forensic accountant, Mr. Einhorn criticized Lehman’s financial statement procedures and made his bearish case at the conference. He was just short of saying that Ms. Callan’s explanations were disingenuous.

“They have $6.5 billion in [collateralized debt obligation] exposure. Approximately 25% of the positions held on Feb. 29 [2007] and Nov. 30, 2007 were rated double B+, or below investment-grade, by recognized rating agencies,” he said. “I asked: You have $200 million write-downs on $6.5 billion CDOs that include 25% below investment-grade?”

Mr. Einhorn also looked at the amount of so-called Level 3 assets disclosed by Lehman between its fourth quarter last year and this year’s first quarter. According to FAS 157 accounting rules, Level 3 assets are completely illiquid, and thus are nearly impossible to price. Mr. Einhorn said that in the fourth quarter, Lehman disclosed in its 10Q filing with the Securities and Exchange Commission $38.8 billion worth of Level 3 assets followed by $40.2 billion in the first quarter for that same category.

“But those 10Q changes did not reflect what the company announced in its conference calls and press releases,” Mr. Einhorn said. He said that when mentioning the discrepancy to Lehman’s management, he was told that gaps sometimes exist between 10Qs and earning calls. He said that he was not convinced by the explanation.

Mr. Einhorn’s final charge was that Lehman’s total disclosed write-downs for its mortgage assets are less than what they should be given the bank’s exposure to those assets.

A Lehman spokesman declined to comment on any of those points, but insiders at Lehman were obviously not happy about the speech.

Depending on one’s position on the stock, Mr. Einhorn’s exposé will be seen either as an attack or a work of serious research, but one can predict that Mr. Einhorn will stick to his guns. At a time when the market is trying to assess the real value of the losses incurred by banks and other financial institutions, the tales of short sellers may gain more credibility as the market tries to make sense of financial statements that sometimes disclose and sometimes hide the amount of exotic and toxic assets.

Too often, Mr. Einhorn complained, Street analysts take the contents of upbeat press releases at face value, relying on the accuracy of financial statements without doing their homework. Worse, he said, hedge funds that short stocks in a bear market often are perceived as the villains, when their role as whistle blowers should instead be respected.

As the battle between Overstock.com Inc. Chief Executive Patrick Byrne and the short sellers in his company shows, there is an anti-short seller sentiment that prevails on many corners of Wall Street, one that corporations such as Overstock have been sure to exploit.

In order to defend itself, Lehman also tapped into the popular aversion to shorts, announcing last month that it notified the SEC about bear raids and malevolent rumors instigated by hedge funds and short sellers trying to bring its stock price down. ...

Mr. Einhorn’s thesis has a gap. To Lehman’s credit, the $6.5 billion in CDO exposure reported in the first quarter represented non-residential mortgages—in other words, CDOs backed by franchise loans, whole business securitization loans, auto loans and credit card loans. The portion of the collateral made of residential mortgages—the riskiest assets—account for only $900 million, according to Lehman.

But this point looks like a small gap compared to Mr. Einhorn’s main point, which is that a quarter of Lehman’s CDO book was rated below investment grade. Lehman’s problems are far from over. While the bank may not be the next Bear, it is now facing a second round of problems...

Posted by

Editor

at

10:47 AM

View Comments

![]()

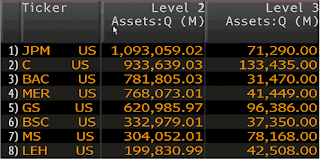

When you add up all the Level II assets by just the eight largest holders in the U.S: JP Morgan (JPM), Citibank (C), Bank of America (BAC), Merrill Lynch (MER), Goldman Sachs (GS), Bear, Morgan Stanley (MS) and Lehman Brothers (LEH), it comes to a staggering $5 trillion - nearly half the size of the economy. Level III assets are nearly $600 billion.

Is the Fed big enough to bail out all these assets? My best guess is probably not, and more firms will fail. If the loans and economy both don’t start performing, these failures will happen more quickly, which is why my firm continues to avoid credit risk. It's not hard to envision an acceleration of this process if the market starts to believe the special loan facilities and other funding processes artificially created to deal with this mess cease to work.

The Fed is slowly becoming the dumping ground for dealers and banks - members of the ‘Moral Hazard Club.’ It's is running out of capital, and quickly.

The problem assets (at least the ones we know about) are way too large for the Fed to completely absorb. It's waiting and hoping the economy and credit markets stabilize before it runs out of ammunition.

Posted by

Editor

at

3:52 PM

View Comments

![]()

The eerily reminiscent slide in Lehman Brothers Holdings Inc. (LEH) picked up steam again on Friday when the stock was down $2.26, or 5.87%, to $36.24 on heavy volume of 28.3 million shares. It was dangerously heading towards its March 52-week closing low of $31.63. Already losing about 16% of its value over the past few trading sessions, the selloff in Lehman is continuing on fears of larger write-downs, and had accelerated intra-day as no one wanted to stay long ahead of a three day-weekend.

The Wall Street Journal noted that on Thursday, Greenlight Capital hedge fund manager David Einhorn spoke at the Ira Sohn Investment Research conference, questioning why the company only wrote down a $6.5 billion collateralized debt portfolio by just $200 million, and also taking issue with large, unrealized gains the firm booked in the first quarter. A known Lehman short seller, Einhorn is not the only one betting on further downside.

In looking at the options market, there is an overwhelming bias towards buying puts, with some tremendous activity in the front month contracts, particularly the out of the money June puts with a strike price of $35, $30 and $22.50 where total volume is in excess of 50,000 contracts. With growing uncertainty surrounding the value of Lehman’s financial assets, the bottom appears to be falling out.

Posted by

Editor

at

10:36 AM

View Comments

![]()

David Einhorn, president of Greenlight Capital, says LEH has not written down enough bad mortgages and says the company should raise capital. Greenlight is short LEH. XLF tumbled 7% on suspicions raised by Einhorn. Najarian thinks unusual put options activity in LEH, 4X more than normal, is similar to what he saw in Bear Stearns before the fire sale. Tim Seymour recommends caution and Macke says the whole group is scary, especially Moody’s admitted it had mispriced a large segment of the debt market.

Posted by

Editor

at

10:31 AM

View Comments

![]()

What if the Worst is Not Over?

By Dan Amoss

Since the rescue of Bear Stearns on March 17, the Amex Securities Broker/Dealer Index has rallied 20%. The shares of Lehman Brothers have rocketed more than 30%. These dramatic rallies support the popular thesis that "the worst is over" for the financial sector. But these dramatic rallies also provide attractive short-selling opportunities for every investor who believes that the "worst is yet to come."

Most of Wall Street's money-making machines have shut down. Mortgage-securitization activity has gone kaput, while IPO and M&A activities are sputtering. Even worse, Billions of dollars of future write-downs and losses are still buried inside Wall Street's balance sheets.

Lehman Brothers (LEH) appears to be among the most vulnerable of all the investment banks. The stock has rallied hard since the Bear Stearns rescue. Because its business model closely resembles that of Bear Stearns, Wall Street thought Lehman was next. And it might have been, if not for the Fed.

The Fed instituted a lending facility allowing the investment banks to temporarily swap the ugliest "alphabet soup" assets for Treasuries. These alphabet soup assets - mortgage-backed securities (MBS), asset-backed securities (ABS), collateralized loan obligations (CLO), and others - had been smothering the brokers to the point that Bear Stearns was hours from declaring bankruptcy.

In the hopeful words of Lehman Brothers CEO, Dick Fuld, the Federal Reserve's lending facility "takes the liquidity issue for the entire industry off the table." Sure, the Fed's actions may have forestalled a modern-day "bank run" on Wall Street. But the Fed has not solved the bigger, longer-term crisis.

The Fed's new facility allows Lehman to temporarily swap its garbage assets for Treasuries. What it doesn't do is protect Lehman shareholders from losses on these securities. Lehman shareholders will be the first to absorb these losses. Shareholders are in the most junior position in every company's capital structure. So the more leverage - or debt - a company employs, the quicker shareholders get wiped out when assets sour.

As the chart below shows, Lehman's equity (in red) supports just a tiny sliver of Lehman's towering liabilities. Lehman's gross leverage ratio amounts to about 32 times equity. This means Lehman's assets can fall only about 3% in value before equity is wiped out.

Lehman is scrambling to reduce leverage and raise capital by selling illiquid assets into a weak secondary market. Unfortunately, illiquid mortgage-backed securities aren't a particularly hot item these days. There are few buyers for such assets - even at steep discounts.

According to Bernstein Research, Lehman's "troubled" residential and commercial mortgage assets amount to nearly three times its tangible equity. That's danger level for Lehman shareholders. And the danger is growing…

Last year, the investment banks, including Lehman, adopted a new Financial Accounting Standards Board rule called "FAS 157." This new accounting rule segregates balance sheet assets according to their liquidity and marketability. "Level I Assets" have readily available market prices. "Level II Assets" can be valued by comparing them to prices of similar assets. But "Level III Assets" lack any observable market price or price inputs. They are "marked to model" - not "marked to market."

So how many Lehman assets are Level II and III? According to its latest 10-Q, Lehman categorized $60.5 billion and $23.8 billion of its mortgage securities as Level II and III assets, respectively. This adds up to $84.3 billion – or more than four times tangible equity per share! Therefore, if just 12% of Lehman's $153 per share in Level II and III mortgage assets were written off - a reasonable assumption - such losses would eat through half of Lehman's tangible equity.

The odd thing about Level III assets, also know as "mark-to-model" assets, is that the owner of them gets to decide how much they're worth. I'm not kidding. Lehman management determines for itself the value of the Level III it owns. Therefore, no one can really know what the true value might be. There's no way to know, for example, what models management uses to value its Level III assets. Hopefully, they are not using the same badly flawed models that predicted smooth sailing for subprime mortgage-backed securities.

This lack of pricing transparency (or pricing reality) can be management's strongest ally…for a while. But eventually, the truth will out. Eventually, the Level III assets will make their way from the dark recesses of Lehman's balance sheet into the unforgiving light of real-world pricing. Eventually, living and breathing buyers will determine the value of these assets, not some mainframe computer in the Lehman back office. And as these real-world transactions occur, Lehman might face billions of dollars of additional write-downs and losses.

Lehman management has not been terribly forthcoming about reporting quarterly losses and write-downs. Brad Hintz from Bernstein Research hinted that fuzzy math produced Lehman's "strong" March earnings report: "We believe the quality of these earnings was weak, as the firm benefited from a lower tax rate and enjoyed a $600 million mark-to-market gain on its liabilities." That's a polite understatement. Believe it or not, accounting rules allow investment banks to book a profit when the value of the bonds they have issued FALL. Follow along with this crazy logic if you can: Because the holders of Lehman's bonds became fearful that Lehman would declare bankruptcy, the bondholders dumped the bonds at very low prices. Therefore, because Lehman's bond prices tumbled, Lehman could, theoretically, buy back the bonds at prices much lower than the stated value of those bonds on Lehman's balance sheet. As a result, this bizarre accounting rule concludes, Lehman can book a "profit" on the difference between the issue price of its bonds and the depressed market prices. Taken to an extreme, Lehman could probably post one if its most profitable quarters ever, just by declaring bankruptcy!

Obviously, falling bond prices indicate financial stress, and certainly do not produce sustainable, high-quality earnings. Such "earnings" do not generate cash or create any value of shareholders whatsoever.

Net-net, Lehman is still facing the likelihood of losing tens of billions of dollars over the course of the next few years. As losses pile up, Lehman will have to raise capital. That means flooding the market with LEH shares. Lehman may have to issue hundreds of millions of new shares at a discount to rebuild its capital shortfall, severely diluting the existing shareholders.

David Einhorn, an accomplished hedge fund manager, recently explained why he's still selling short Lehman shares. In a speech at the April 8 Grant's conference, he said that Lehman may have to boost its capital by as much as $30 to $70 billion. If Einhorn's guesstimate is anywhere close to the mark, Lehman's shareholders are in for a very rough ride.

The worst might be over for the financial sector, just like so many investors seem to believe. But a lot of bad stuff is still rolling our way. For the rest of 2008, therefore, investors might want to take their cue from Credit Suisse CEO Brady Dougan when he said, "The number of times people have seen the light at the end of the tunnel, it turned out to be a train coming down the tracks."

Posted by

Editor

at

9:36 AM

View Comments

![]()

Lehman Brothers (LEH) raised $4 billion dollars to allegedly "prove" to the market that it was liquid and had confident investors and trading partners. I didn't believe that to be the real reason then and I really don't believe it now.

The news is out that the Fed has probably hit a floor in dropping rates, with inflation and unemployment concerns rising. As I stated in my earlier articles on the banking industry , this spells trouble for banks relying on expanding net interest margins to bail them out of their insolvency situations. I knew this was bound to happen, for effective (headline) inflation is out of control and we are bordering negative rates as it is. So as a result, those banks facing the potential of insolvency are now that much worse off. This is a big deal for the investment and commercial banks - a very big deal. My next few posts will concentrate on this, and I will wind them up with a few more of my personal shorts in the sector. Now, back to Lehman...

Lehman raised $4 billion dollars about a month ago. That is the credit. Now let's add up the debits:

* They had to buy out two investment funds that they ran, engulfed in losses, for $1.8 billion.

* They are rumored to have losses on their portfolio and their hedges, to the tune of about $1.5 billion to $2 billion .

* They are firing about 5% of their workforce which will demand severance packages, let's say conservatively about $100 million.

* They issued a smoke and mirrors earnings report last quarter which hid the fact that they took a cash loss. This means that the IB broken business model is probably taking effect already at this institution.

Now, if we have 4 in inflows, subtract 1.8, less 1.7, less .1, we get $3.6 billion in outflow. I am assuming Lehman didn't net the full $4 billion that was stated as the gross offering amount. So, roundabout, net-net, Lehman is pretty much back where they started from when the market was driving their stock down to $20.

I am obviously not the only one who has this funny calculator since Lehman dropped 6.5% yesterday.

Posted by

Editor

at

10:51 AM

View Comments

![]()

The U.S. credit crisis will extend into and even beyond 2009 as banks will write off more than $170 billion of additional reserves by the end of next year, according to Oppenheimer & Co. estimates.

``The real harrowing days of the credit crisis are still in front of us and will prove more widespread in effect than anything yet seen,'' analysts led by Meredith Whitney wrote in a research note today. ``Just as strained liquidity pushed so many small and mid-sized specialty finance companies to beyond the brink, we believe it will do the same with the U.S. consumer.''

"... in our opinion the "next shoe to drop," is what became an over-reliance on the securitization market for consumer liquidity. Herein, we draw a direct correlation between a shutdown in securitization volumes and accelerating losses on bank balance sheets. As we see no near or medium term come back in securitization volumes, we believe losses will only accelerate further and far worse than even the most draconian estimates."

Posted by

Editor

at

4:46 PM

View Comments

![]()

Reuters reported that Lehman Brothers laying off nearly 5% of its workers globally amid difficult market conditions. The latest cuts are in addition to the layoffs of more than 5,000 people since mid-2007.

Posted by

Editor

at

10:21 AM

View Comments

![]()

A black swan event, loosely described, is an occurrence that: 1) is structurally possible within a system, 2) is of very low probability within that system, but which 3) should it take place has a disproportionate impact upon the systemic order. Does the present financial crisis as a whole represent a low-probability nonlinear transformation of the US or the global financial system, or of major markets therein? In my view, no---or at least, not yet.

The financial community does not use the black swan terminology, but the claim is the same: "Our crisis was not foreseeable." "The system is liquid, it's just in a stubborn panic." "We are the victims of fraud and a lack of transparency; wider remedies would be unhelpful." "Financial innovations are sound, and they did not contribute to unanticipated market instabilities." We have 'an accident' where no one at the scene claims to be or know the driver.

On present examination neither the bubble nor its crash fit the black swan hypothesis. Many if not most of the component processes of both were linear, highly probable, and fully visible.

Mortgages increasingly came to be originated to borrowers at the bottom of the financial system whose capacity to pay depended upon the continuation for decades of historically very low interest rates; similarly, hundreds of billions of dollars were lent for securitized junk bond debt speculation at the top of the financial system where the viability of that debt also depended upon the continuation of historically low interest rates; concurrently with these entirely observable trajectories, bank-like speculative vehicles proliferated which borrowed, lent, and underwrote the quasi-insurance of credit default swaps to very large sums, again facilitated by historically low interest rates and by borrowing at the extreme short term via commercial paper offerings to capture the best rate spreads. No commercial bank was then permitted to operate with the severe leverage, lack of hard reserves, and term mismatches of these 'wildcat banks,' to resort to an historical term, since these practices, severally and jointly, have a strong association with financial failure.

If, when, and as rates rose, large portions of these debts would turn sour. If these debts went sour, the value of the securitized loans as collateral would decline. If the value of the collateral declined, the terms for short term loan refinancing would shift higher in rates and requirements even if liquidity remained constant. These were linear relationships of high probability.

By the autumn of 06, both residential real estate prices and residential mortgage failures had diverged so extremely from long-term trends that if these shifts were sustained the changes themselves would have represented a nonlinear systemic transformation. Instead, the observable linear relationships held: mortgage delinquencies rose and home prices flattened as interest rates rose, maintaining their historical correlations if at extreme values: not New and Different but More of the Same only more so.

A drop of 300 basis points in interest rates did not reinflate the mortgage, junk bond, or commercial paper markets since accelerating housing price declines at the bottom of the financial system and major unrealized losses at the top of the financial system served as ironbound negative indicators for loan risk.

If the exact circumstances for the implosion of Bear Stearns in March remain opaque, it is clear that they faced a major run of customers, cascade of margin calls, and withdrawal of dealer counterparties: a very large if old-fashioned bank run performed by financiers rather than retail depositors. There has yet to be any mention of a precipitating major loss for BSC from a nonlinear event. All of these events, and likely more to come, are directly driven by linear price declines in massive quantities of securitized debt, trajectories which were largely locked in from the date of issuance for these instruments.

The surge and purge of the Securitization Bubble has not been a black swan event; it has been a cooked goose event. In that respect as in prior historical examples, the faces change but the fools remain the same. A salient hypothesis from this summary, to which I'll return, is that to the extent that nonlinear processes figured in these trajectories, they were in the making of the bubble more than in the baking of it. The 'black swan' metaphor fails 2), its low probability condition. In fact, we have not even seen 3), a real shift in systemic order in the financial system---yet.

Despite well-publicized failures of some exposed small and mid-size operators, there has been no default cascade to this point, either of short-term obligations of securitized debt holders or swap counterparties. Few banks or bank-like entities have failed outright, though only due to massive public lending. Over the counter securitized debt transactions can and do take place, though they have become rare. Liquidity is in the system for mundane commercial loans, though money is far more expensive. Mortgages are still issued, though far fewer and none at all for higher valuations; the volume declines are linear expressions, however. Local government revenues are declining, but service collapse, bond defaults, and bankruptcies are not widespread. Yet; not yet. And so long as price declines for securitized assets are not realized faster than asset holders acquire offsetting capital, such outright market failures may not happen at all.

Those asset price decline trends?: they appear to be accelerating, and have a long way to run; a long way in relation to historical prices; a long way in relation to inventories; a long way in relation to solvency. We haven't seen truly non-linear changes in the financial system---yet, i.e. (sustained) turbulence, catastrophic order transformation (say of market volume, market participants, or currency), or chaos.

Posted by

Editor

at

9:02 AM

View Comments

![]()

There seems to be sentiment developing that the U.S. has weathered the worst of the current cyclical economic storm and blue skies are ahead. We disagree. Any blue skies you see are likely to be short lived. The economy is in the relative calm of the eye of the business-cycle hurricane. The mortgage credit problems are not over. And credit problems in other sectors are just beginning as the housing recession spreads to the rest of the economy.

The plus-sign in front of the Commerce Department’s preliminary estimate of the change in first-quarter real GDP was deceiving. Real final sales of domestic product, which is real GDP excluding the change in business inventories, contracted at an annual rate of 0.2% in the first quarter.

Real private final domestic sales – i.e., the sum of personal consumption expenditures and private fixed investment expenditures – contracted at an annualized rate of 1.0% in the first quarter, which was the largest contraction since the fourth quarter of 1991 (see Chart 1). So, the housing recession is now spreading to consumer spending, business equipment spending and nonresidential construction spending.

Blackstone Group LP President Tony James said banks are mistaken if they think credit markets have begun a sustained recovery. ``It's not clear to me if it's a permanent upswing as I think many of the banks are saying or the eye of the hurricane,'' James told reporters on a conference call today. Source

Myron Scholes, chairman of Platinum Grove Asset Management LP and 1997 winner of the Nobel Prize in economics, said the worst of the crisis in credit markets may not be over. ``From my perspective, I think that we don't know if the storm has passed or if we are still in the eye of the storm,'' Scholes said in an interview with Bloomberg Radio yesterday. ``Are there other shoes to drop and new events or new shocks that will come to the fore?'' Source

Posted by

Editor

at

4:42 PM

View Comments

![]()

In an interview with the Financial Times, Richard Shelby, the senior Republican on the Senate banking committee, said Fannie Mae and Freddie Mac were "thinly capitalised, highly leveraged and pose a systemic risk to taxpayers".

Financial Accounting Standard 157 allows companies to estimate a value on holdings that aren't traded. Freddie Mac increased its Level 3 assets under FAS 157 to $156.7 billion, or 23 percent of its assets, from $31.9 billion as of December. The company also adopted FAS 159, which lets it pick which financial assets and liabilities to measure at fair value through earnings.

Chief Executive Officer Richard Syron said the new accounting better reflects ``the underlying performance of our business'' as the market continues to deteriorate.

So much for transparency. Source

James Lockhart, the directory of OFHEO, said at a conference that Fannie Mae and Freddie Mac's thin capital ratios posed a risk to taxpayers, financial institutions, and investors (WSJ). Fannie Mae and Freddie Mac have core capital ratios of less than 2% of the mortgages they guarantee. Fannie's core capital is around $50 bln, but would need to be $135 bln to be considered well capitalized according to an industry analyst. Source

Posted by

Editor

at

8:54 PM

View Comments

![]()

While markets have improved, they remain ``far from normal,'' Bernanke said today in a speech to an Atlanta Fed conference at Sea Island, Georgia. ``We stand ready to increase the size of the auctions if further warranted by financial developments.''

Bernanke's comments contrast with those by Treasury Secretary Henry Paulson and Wall Street leaders including Vikram Pandit, chief executive officer of Citigroup Inc., who say the worst of the credit crisis is over. The Fed chief said it will take ``some time'' for financial firms to resolve the crisis by raising new capital and strengthening their management of risk.

Posted by

Editor

at

8:58 AM

View Comments

![]()

U.S. and European banks and financial institutions have ``enormous losses'' from bad loans they haven't yet recognized and may have a harder time wooing sovereign-fund rescuers, Carlyle Group Chairman David Rubenstein said.

Posted by

Editor

at

4:57 PM

View Comments

![]()

Diane Vazza, S&P's credit chief, says defaults are rising at almost twice the rate of past downturns. "Companies are heading into this recession with a much more toxic mix. Their margin for error is razor-thin," she said.

Two-thirds have a "speculative" rating, compared to 50pc before the dotcom bust, and 40pc in the early 1990s. The culprit is debt. "They ramped it up in the last 18 months of the credit boom. A lot of deals were funded that should not have been funded," she said.

Some 174 US companies are trading at "distress levels". Spreads on their bonds have rocketed above 1,000 basis points. This does not cover the carnage among smaller firms outside the rating universe.

Posted by

Editor

at

8:25 AM

View Comments

![]()

“This was certainly a market bottom, and a pretty good market bottom,” said Duncan W. Richardson, chief equity investment officer at Eaton Vance, the asset management firm in Boston. “But I don’t know if it was the bottom.”

“It’s our significant worry that corporate profits in the nonfinancial part of the system are likely to be weak over the next couple of years,” Mr. Inker said. “If we’re right, and corporate profits are going to start to deteriorate outside the financials, it will cause another round of problems.”

Posted by

Editor

at

9:26 AM

View Comments

![]()

# Warren Buffet says "there's going to be more pain" and that the Bear Stearns bailout "doesn't mean the losses are over by a long shot."

# After taking $45 billion in write-downs and losses over the past nine months, Citigroup announces plans to sell $400 billion in assets in an attempt to keep itself afloat.

# American International Group announced another round of record quarterly losses, detailed plans to raise $12.5 billion in capital, and said that there can be "no assurance" that the losses are over.

# The Financial Times reported that "Bankruptcies and Defaults Gather Pace"

Posted by

Editor

at

8:32 PM

View Comments

![]()

The banking giant said Friday it will sell at least $400 billion of the $500 billion in legaccy assets it identified as "not central" to its mission, including $170 billion worth of marked-to-market assets in its investment banking division. The planned sale, which will take place over the next three years, is more than double what analysts expected.

For example, of the $500 billion in "legacy assets," $30 billion is in highly leveraged loan commitments, another $25 billion is toxic subprime collateralized-debt obligations, and $55 billion is in off-balance-sheet entities that are highly illiquid. The rest are in real estate ($175 billion) and auto loans ($20 billion).

The New York Times on Friday said Pandit is preparing to sell Citigroup's Primerica Financial life insurance and mutual fund complex, the business on which Sandy Weill built his financial empire. Other divisions likely for sale are a back-office outsourcing unit in India, retail brokerage operations in Australia, and possibly bank branches in Germany, according to the paper. Citigroup, according to sources, also may be trying to sell its defined-benefit business operations in Latin America.

Posted by

Editor

at

10:40 AM

View Comments

![]()

In the immediate aftermath of the Bear Stearns meltdown — and by immediate, I mean within days — the SEC has focused on the need to change the standards for measuring the adequacy of liquidity in light of the "run on the bank" that Bear experienced. Three days after the Bear transaction, I wrote to the Basel Committee to offer strong support for extending the existing capital adequacy standards to deal explicitly with liquidity risk. And in the ensuing weeks, the SEC has arranged to join with the Basel Committee in this important work. At the same time, without waiting for new internationally accepted standards, the Division of Trading and Markets has strengthened the liquidity requirements for CSE firms relative to their unsecured funding needs. They are closely scrutinizing the secured funding activities of each CSE firm, with a view to lengthening the average term of secured and unsecured funding arrangements. And they are currently obtaining funding and liquidity information for all CSEs on a daily basis, and discussing with CSEs the amount of excess secured funding capacity for less-liquid positions. There will also be more disclosure of actual capital and liquidity positions of the CSE firms in terms that the market can readily understand and digest. The CSEs will institute public disclosure of their capital ratios computed under the Basel Standard later this year, and then phase in additional disclosure related to concentration of exposures.

Posted by

Editor

at

4:35 PM

View Comments

![]()

Despite P/E contraction since July 2007, market is not cheap. Historical average P/E b/w 15-16 is based on 1-year trailing reported earnings, not on forward operating earnings. S&P 500's current P/E of 20.5 as of Apr 10 is at top of historical range based on forward earnings

Posted by

Editor

at

3:03 PM

View Comments

![]()

In mid-March – at the peak of the crisis - the Fed did not just partially bail out the Bear Stearns shareholders who would have been totally wiped out in the case of a disorderly collapse of Bear Stearns; more importantly the Fed effectively bailed out JP Morgan that had – like Bear – and still has a massive exposure to the CDS market; it bailed out the creditors of Bear Stearns who would have suffered massive losses if the Fed had not outright bought $29 billion of toxic securities held by Bear; and it effectively bailed out Lehman, Merrill and a good chunk of the shadow financial system as the Bear Stearns bailout – together more importantly with the new TSLF and the PDCF facilities – ensured – for the first time since the Great Depression - that systemically important broker dealers would have access to the lender of last resort support of the Fed. Without these new facilities and the Bear bailout a generalized run on many institutions of the shadow banking system would have occurred.

While the extreme tail risk of a systemic financial meltdown – and we were in mid-March one epsilon away from such a generalized run on most of the shadow banking system – was avoided by the trifecta of the Bear Stearns bailout, and the creation of the TSLF and the PDCF facilities the stresses in the financial markets – liquidity and credit crunch - remain severe as even the FOMC had to admit in its latest statement.

The severity and persistence of the liquidity crunch is evident from the fact that in the interbank markets spreads (Libor/OIS + TED) remain extremely high and still close to their peaks since this crisis started last summer in spite of 325bps Fed Fund ease by the Fed, in spite of the creation and vast expansion of the TAF auctions (now up to $150 billion over a month), in spite of the creation and extension of the TSLF, in spite of the creation of the PDCF.

Why? Banks and non bank primary dealers having access to the Fed liquidity are hoarding such liquidity and not relending it to the other members of the shadow banking system for two reasons. First, they need that liquidity for themselves as the roll-off of SIV and conduits and concerns about future liquidity needs have led to a massive need for liquidity insurance; second, given the counterparty risk – who is holding the toxic waste and how much of it – that an opaque and non-transparent financial system has created no one trust its counterparties and is willing to lend them money on a term basis.

Thus, monetary policy can address illiquidity problems but cannot resolve credit and insolvency problems. And this US economy now suffers of a virulent strain of illiquidity and insolvency problems. So the liquidity crunch remains severe in spite of all of the extreme policy actions by the Fed and other central banks.

Posted by

Editor

at

11:39 AM

View Comments

![]()

From Reuters: JPMorgan says no near end to financial crisis: report

"We can only speculate how deep and how long the recession in the United States will really be and how that in turn will impact banks," [JPMorgan Chase & Co CEO] James Dimon told "Welt am Sonntag".

"But we are not done with the crisis for a long time," Dimon said ...

And from Goldman Sachs: Eye of the Storm (research report no link). Goldman argues there is a "gaping hole in the side of the U.S. economy" from falling house prices (significantly more price declines to come in their view) and too much supply.

[Fiancial market] relaxation is unlikely to mark the start of a sustainable recovery.

... the evidence for spillover effects from housing via the credit crunch, wealth effects, and multiplier effects in the broader economy is mounting, particularly as far as consumption is concerned. ... In an absolute sense, the data this week were clearly quite poor.

And from the WSJ: Downgrades Show Storm Isn't Over

ResCap's credit rating was cut deep into "junk" territory after it unveiled plans to restructure $14 billion of debt and possibly borrow billions more from its parent, GMAC LLC.

Countrywide's debt rating was slashed to junk from investment grade by Standard & Poor's after Bank of America Corp. said it isn't sure it will stand behind roughly $38 billion of Countrywide debt.

Credit markets have become substantially calmer since the Federal Reserve helped avert a complete collapse by Bear Stearns Cos. in March. Friday's downgrades were a reminder that other big financial institutions are still struggling under the weight of problem mortgages.

Posted by

Editor

at

3:34 PM

View Comments

![]()