Sunday, August 31, 2008

Wednesday, August 27, 2008

Fed Running Out of Treasuries to Swap!

Mish says, "[a}t the current pace, the Fed runs out of treasuries about a year from now. Things are about to get very interesting. Chart Courtesy Cumberland Advisors.

Posted by

Editor

at

8:34 AM

View Comments

![]()

Friday, August 22, 2008

Tuesday, August 12, 2008

Tuesday, August 5, 2008

Auto Industry Default Risk Soars to 95% on GM, Ford.

Contracts to insure $10 million of General Motors Corp. debt cost a record $4.7 million upfront plus $500,000 a year, indicating an 84 percent chance of default, while Ford Motor Co. has at least a 75 percent risk, according to UniCredit data. Combined with Chrysler LLC, the probability that one of the three will be unable to fund its business is more than 95 percent.

GM, the world's largest automaker, reported the third- biggest loss in its 100-year history last week, while Ford said it's shutting down two plants making its best-selling F150 pickup as U.S. auto sales tumbled 13 percent in July. Chrysler's failure to get all of the $30 billion in renewed funding it sought this week may restrict its ability to finance sales to customers and dealers.

``There might be a default at any time,'' said Jochen Felsenheimer, the Munich-based head of credit strategy at UniCredit, Europe's fourth-biggest bank. ``The costs imply there is close to 100 percent probability that one of the big three will file for Chapter 11 bankruptcy.''

Contracts on Dearborn, Michigan-based Ford, the second- biggest automaker, cost $3.9 million in advance and $500,000 a year. Credit-default swaps on Auburn Hills, Michigan-based Chrysler loans are $1.9 million upfront and the annual $500,000 charge, UniCredit prices show.

Almost 29 percent of Detroit-based GM's stock available for trading has been sold short, compared with 15 percent for Ford, based in Dearborn, Michigan, according to Bloomberg data.

Posted by

Editor

at

3:29 PM

View Comments

![]()

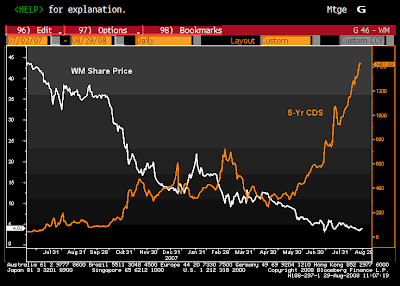

Year of Lending Dangerously

On August 9 2007, the European Central Bank sent shock waves around world financial capitals when it injected €95bn ($150bn, £75bn) worth of funds into the money markets to prevent borrowing costs from spiralling sharply. The US Federal Reserve soon followed suit. But while the central banks had billed these moves as “pre-emptive” actions to quell incipient market tensions, they did not bring the panic to an end... A year later, there is still no sign of an end to these problems. Instead, the sense of pressure on western banks has risen so high that by some measures this is now the worst financial crisis seen in the west for 70 years.

Posted by

Editor

at

9:08 AM

View Comments

![]()

Monday, August 4, 2008

Housing Lenders Fear Bigger Wave of Loan Defaults

The percentage of mortgages in arrears in the category of loans one rung above subprime, so-called alternative-A mortgages, quadrupled to 12 percent in April from a year earlier. Delinquencies among prime loans, which account for most of the $12 trillion market, doubled to 2.7 percent in that time.

“Subprime was the tip of the iceberg,” said Thomas H. Atteberry, president of First Pacific Advisors, a investment firm in Los Angeles that trades mortgage securities. “Prime will be far bigger in its impact.”

Data on securities backed by subprime mortgages show that 8.41 percent of loans from 2005 were delinquent by 90 days or more or in foreclosure in June, up from 8.35 percent in May, according to CreditSights, a research firm with offices in New York and London. By contrast, 16.6 percent of 2007 loans were troubled in June, up from 15.8 percent.

Prime and alt-A borrowers typically had a five- or seven-year grace period before payments toward principal were required. By contrast, subprime loans had a two-to-three-year introductory period. That difference partly explains the lag in delinquencies between the two types of loans, said David Watts, an analyst with CreditSights.

Posted by

Editor

at

1:02 PM

View Comments

![]()

Subscribe to:

Posts (Atom)