June 18, 2008 via nc: RBS (Royal Bank of Scotland) sends out a red alert, warning private clients to prepare themselves for a full fledged rout in equities and bond markets in the next three months, with the S&P losing 300 points, or nearly a quarter of its value, by September. Also: iTraxx index of high-grade corporate bonds could soar to 130/150 while the "Crossover" index of lower grade corporate bonds could reach 650/700

Source: RBS Publishes Global Stock and Bond Crash Alert

June 26, 2008 Fleckenstein Capital "It's About to Blow!"

"...[B]ehind the scenes, many parts of the credit/mortgage market were "offered only." He said it had nothing to do with month-end or quarter-end. Instead, he believed it had to do with the enormous amount of inventory that would be looking for a home in the next quarter. He believed that the equity market was "miles behind what was occurring in the mortgage-backed/credit markets." Though he noted that he'd said it before, he repeated: "It's never been this bad."

CR: And I heard confirmation from a bond shop today that "liquidity is getting worse and worse". Here we go again? Source

June 27, 2008 At 10:02 AM EST today

Barclays Capital has advised clients to batten down the hatches for a worldwide financial storm, warning that the US Federal Reserve has allowed the inflation genie out of the bottle and let its credibility fall "below zero".

"We're in a nasty environment," said Tim Bond, the bank's chief equity strategist. "There is an inflation shock underway. This is going to be very negative for financial assets. We are going into tortoise mood and are retreating into our shell. Investors will do well if they can preserve their wealth." Source

June 28, 2008 "Fortis predicts US financial meltdown within weeks"

American 'meltdown' reason for money injection Fortis.

28th of June, 9:10 (GMT+1)

BRUSSELS/AMSTERDAM - Fortis expects a complete collapse of the US financial markets within a few days to weeks. That explains, according to Fortis, the series of interventions of last Thursday to retrieve € 8 billion. "We have been saved just in time. The situation in the US is much worse than we thought", says Fortis chairman Maurice Lippens. Fortis expects bankruptcies amongst 6000 American banks which have a small coverage currently. But also Citigroup, General Motors, there is starting a complete meltdown in the US" Source in English Source in Dutch

June 29, 2008 Back to the Great Depression?

Few are gloomier about that prospect than Albert Edwards, strategist at Société Générale in London. “America is leading the way, diving into deep recession as a collapse in consumer confidence induces the great unwind,” he said. Edwards compares the economy with a pyramid scheme that is poised to crash to earth and interest-rate changes can do nothing to avert it.

He thinks Wall Street and the other main markets have a lot further to drop, and will end up 70% below the peaks of last year. That would imply a level of just 500 for the S&P 500, which was at 1,280 on Friday, and 4,500 for the Dow, compared with Friday’s closing level of 11,346.

The FTSE 100, which closed at 5,530 on Friday, will plunge to 3,000, he predicts. The good news is that he expects the oil price, which was above $142 on Friday, to slump to $60 a barrel. The bad news is that he sees this occurring as a result of “deep” recession in the advanced economies and a sharp slowdown in emerging markets. Source

June 29, 2008 What we can do in this dangerous moment-Larry Summers

It is quite possible that we are now at the most dangerous moment since the American financial crisis began last August. Staggering increases in the prices of oil and other commodities have brought American consumer confidence to new lows and raised serious concerns about inflation, thereby limiting the capacity of monetary policy to respond to a financial sector which – judging by equity values – is at its weakest point since the crisis began. With housing values still falling and growing evidence that problems are spreading to the construction and consumer credit sectors, there is a possibility that a faltering economy damages the financial system, which weakens the economy further.

June 30, 2008 Global economy faces deep slowdown, warns central bankers' club

The global economy may be heading for a far deeper crisis than is expected and a bout of deflation in the world's biggest economies is now a possibility, according to one of the world's most highly regarded economic institutions.

The Bank for International Settlements has warned that many in the City and elsewhere may have underestimated the scale of the coming economic downturn in one of its most sombre portraits yet of the international financial system. The report draws stark comparisons between the current crisis and a variety of others including the Great Depression. Most sobering is the report's warning that developed economies including the US and Britain could face deflation.

Sunday, June 29, 2008

Meltdown Warnings Are Accelerating from Months to Weeks to only a Few Days!

Posted by

Editor

at

4:38 PM

View Comments

![]()

Tuesday, June 17, 2008

Thursday, June 12, 2008

In Lehman Fallout, Two Stars Are Given Lesser Roles

Now, it will fall to Mr. Fuld to persuade both investors and employees that Lehman is sound. He plans to meet with the managing directors in New York and London next week to try to improve morale. Lehman may yet sell part of itself to a strategic investor in South Korea, which would most likely buy the stake in the open market, said a person close to the talks.If this happens the open market purchase of $5 billion of common stock at $20/share would require 250 Million shares or about 2 days volume which would drive the price up to over $30.

Posted by

Editor

at

10:20 PM

View Comments

![]()

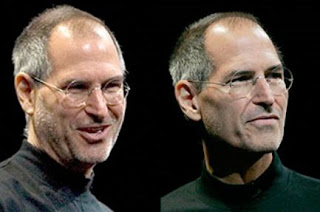

Apple has "No Comment" on Steve Jobs Health Rumors (Barrons) at 2:57 PM PST

A spokeswoman for Apple (AAPL) today said the company was not going to respond to rumors and speculation about the health of CEO Steve Jobs. Four years ago, Jobs had surgery for pancreatic cancer. The spokeswoman would not discuss speculation that he may have had a recurrence.

Concerns about Jobs cropped up on Monday following his keynote address at the company’s Worldwide Developers Conference in San Francisco. As I noted in a post on Tuesday, Jobs looked to some observers to be unusually thin. Apple on Tuesday said that Jobs had recently had a “common bug” that was treated with antibiotics, which the spokeswoman noted again today.

But rumors about his health have persisted over the last several trading days, and are weighing heavily on Apple shares today. AAPL is off $7.73, or 4.3%, at $173.08.

Posted by

Editor

at

3:18 PM

View Comments

![]()

Jobs' health questioned again

At its Worldwide Developers Conference on Monday, the company announced a new 3G version of the iPhone in a push to target mainstream consumers. But a strong undercurrent at the event focused on the emaciated appearance of co-founder and CEO Steve Jobs. While Jobs looked especially gaunt in his trademark black turtleneck and faded jeans, other Apple executives spent more time on the stage during his keynote address -- a notable move for an executive who typically spends much of his speech rallying the Mac faithful and introducing many products himself.Source

The press is so far treading with caution. The first observations on Jobs' health came from the blogosphere. Sites such as Silicon Valley gossip blog ValleyWag and Silicon Alley Insider initially braved the touchy topic. Henry Blodget at Silicon Alley Insider apologized upfront for bringing up the personal subject, before wondering if Jobs has had a recurrence of the cancer that he successfully fought but kept hidden from investors until after his surgery.

The mainstream media has been somewhat more cautious. Dow Jones Newswires and New York City's favorite tabloid, the New York Post, have run stories on Jobs' appearance, as well as a technology blog by The Wall Street Journal. (the Journal, Dow Jones Newswires, the New York Post and MarketWatch are all owned by News Corp

Investors did not learn of Jobs' last bout with cancer until after his surgery. Fortune reported earlier this year that Jobs was diagnosed with a rare but treatable form of pancreatic cancer in 2003 and avoided surgery for nine months while he tried alternative remedies. Apple's board of directors sat on the news the entire time after consulting with attorneys, who reportedly advised the company that they could remain silent on the issue to investors.

Katie Cotton, an Apple spokeswoman, told reporters who inquired that Jobs was hit with a common bug two weeks ago and he's been on antibiotics, getting better day by day and didn't want to miss WWDC. "That's all there is to it," she told Dow Jones Newswires on Tuesday.

In the comparison with Warren Buffet, it should be noted that the billionaire investor -- also not known for showcasing details of his private life -- took pains to send out a press release before going into surgery to remove a benign growth in his colon in 2000.

Scathing comments on the posts and stories on this topic have accused the bloggers and writers of National Enquirer-like tactics and invading Jobs' personal privacy, showing how touchy the subject is. This column will also be surely attacked by Apple fanboys. But many investors, corporate governance experts and others consider news about a CEO's health material to the company's livelihood.

"For any firm, the health of the CEO is a material subject," said Kirk Hanson, executive director of the Markkula Center for Applied Ethics at Santa Clara University. "For Apple, Steve Jobs' health and well-being are more central to the stock price -- and probably to the future of the company than any other single thing."

"It reminds me of the Kremlin watchers during the Communist era," Roger Kay, president of Endpoint Technologies, said of the recent chatter over Jobs' health. "Did Stalin sneeze?... So people have made the comparison with the control that Apple exerts. As a result people find themselves parsing everything."

Stalin, of course, did not live forever. If Jobs were to ever become ill again, I hope that Apple would disclose the news in a timelier manner to investors, who need the company to be more forthcoming and not a version of the Kremlin in Silicon Valley.

Posted by

Editor

at

8:11 AM

View Comments

![]()

Wednesday, June 11, 2008

A Sinking Feeling About Lehman

How low can Lehman Brothers go?

The brokerage's shares fell for the fourth day in a row Wednesday, in the wake of Monday's announcement of a quarterly loss of $2.8 billion and plans to raise $6 billion of capital. Lehman shares slid 13.6%, or $3.75, to close at $23.75. It has fallen 26.5% so far this week. The real decay in the stock began when Merrill lowered its rating on the stock. The week before, it had taken a neutral rating to a buy, and has now reversed itself. Source

"They diluted the shareholders that much, and now they may need more capital? There's a real crisis of confidence in management here," Bill Smith, chief executive officer of Smith Asset Management, told Reuters. Smith Asset Management sold its Lehman shares at the open Wednesday morning.

Its $6 billion fundraising plan comes after numerous rumors that the company was strapped for cash, which had been met by denials. (See: "Lehman Doesn't Need The Money")

Wednesday also brought a slew of analyst commentary predicting smaller profits for years due to the dilution from its plan to raise $6 billion in new capital. Wachovia's Douglas Sipkin said the plan dilutes profits by more than 20%, and its effects will be felt for a long time. He was also critical of the company's timing, arguing that it could have raised equity at higher prices had it offered the new shares in April. Merrill Lynch also downgraded the company after giving it a "buy" rating on June 4.

Options volatility in Lehman shot through the roof, with two times as many bets against the stock as bets that it will gain. There was unusual activity in July put options. More than 43,000 contracts traded hands at a $15 strike price. Before today, this particular contract had volume in the 9,000 range. Rebecca Engmann Darst, an analyst at Interactive Brokers, said the activity is split between buyers of puts and sellers, which suggests some of the volume was short-sellers hedging their positions.

See also Fed Discount Window Mixed Blessing for Lehman

Posted by

Editor

at

8:47 PM

View Comments

![]()

Future of Financials - Meredith Whitney

CNBC Video Link

June 11, 2008 at 12:12 EDT (8:24)

With Comments on Lehman Brothers

Posted by

Editor

at

3:25 PM

View Comments

![]()

Lehman is Not Out of the Woods - Jim Cramer

TheStreet.com (2:50)

Posted by

Editor

at

3:17 PM

View Comments

![]()

Tuesday, June 10, 2008

Dick Fuld's strategy has Lehman fighting for its life

It's no surprise that when the fallout from the subprime mortgage mess made the securities built from those toxic loans start wrecking balance sheets across Wall Street, Dick Fuld zigged when everyone else zagged. But Lehman was the biggest underwriter of subprime debt in 2006, and the nation's fourth-biggest investment bank refrained from shedding the junk or writing it off fast enough.

By March, Lehman was helped and hurt by its smaller rival Bear Stearns Cos. Bear made Lehman look good, because the former was better diversified, hadn't had an unprofitable quarter and, not least, had Dick Fuld at the helm. But Bear and its collapse also suggested how fragile these institutions had actually become. Bear disappeared in about three days after counterparties began bailing out. Before it was even over, these panicked investors began looking at the next weakest link: Lehman.

By Monday, Fuld and Lehman had been forced to do what they had been avoiding for a year, raising close to $6 billion in cash by selling a big stake in the firm. The move was aimed at restoring confidence to Lehman in the markets, but it also clobbered investors who had watched their stakes shrink by more than half in less than a year.

Einhorn, however, isn't finished. He rightly points out that the number that may ultimately do in Lehman is $65 billion. That's the amount of hard-to-sell assets still on its balance sheet. Fuld could have been writing this junk off over the last year just like his rivals, but again, Dick Fuld doesn't operate like his peers. It's for these reasons that Fuld should lead the Lehman army forward -- by making his own retreat.

Posted by

Editor

at

9:01 PM

View Comments

![]()

Lehman Credibility ?

Even though Lehman did take write-downs, reduce leverage and raise capital in the second quarter, he says it's not enough. "Lehman is raising $6 billion that they said they didn't need to replace losses that they said they didn't have," Einhorn said Monday. "Since the credit markets actually improved this quarter, such losses primarily reflect losses that might have been taken in prior quarters. A preliminary analysis of the pre-release and conference call suggests that there are still unrecognized losses on the balance sheet." Source

Oppenheimer & Co. banking analyst Meredith Whitney on Tuesday slashed estimates for Lehman, lowering her full-year estimate for 2008 to a loss of $3.34 from a profit of $1.58. "There is too much uncertainty with potential losses on Lehman's remaining gross exposures," even though the shares may seem ``inexpensive'' at 0.9 times book value, Whitney wrote in the note today. Source "We estimate that the most recent capital raise is 30% dilutive to existing shareholders," Oppenheimer's Whitney wrote, "and that the sheer size of such a dilutive capital raise will put serious pressure on Lehman's ability to deliver on meaningful earnings per-share growth over the near to medium term."Source

Wachovia's Sipkin remained skeptical as well about Lehman management's take on what caused the losses and how they were valued."Another surprising development was the fact that losses were triggered by mark-to-market adjustments, not so much by hedging or asset sales as previously indicated," he said. "This is another fact that is somewhat inconsistent from what we heard in the past." Source

Sipkin downgraded the stock to "Market Perform" from "Outperform," questioning Lehman Brothers' timing. He said the company could have raised "meaningfully more equity at higher prices" if it had offered the new shares in April. On April 1, the company raised $4 billion by selling preferred stock at a price of $49.87 per share. Source

Lehman's Callan assured investors and the media in March that a $1.9 billion preferred stock sale "took care of our full-year needs" for funding. But several weeks later, as the rumor mill spun furiously with questions about Lehman's health, the firm raised an additional $4 billion. On Monday, the firm raised another $6 billion. Source

Posted by

Editor

at

2:41 PM

View Comments

![]()

Sunday, June 8, 2008

Derivatives Traders Signal Bank Woes Likely to Worsen

Interest-rate derivatives traders are betting banks' difficulties obtaining cash to fund holdings and shore up balance sheets will worsen.

The difference, or spread, between the three-month dollar London interbank offered rate, or Libor, and the overnight index swap rate, traded forward three months, is greater than similar spreads expiring this month, according to data tracked by Credit Suisse Holdings Inc.

``The movement in the forward Libor-OIS spreads is telling you that the market is concerned that things can get even worse before they get better,'' said Carl Lantz, an interest-rate strategist in New York at Credit Suisse. ``Until all banks' balance sheets are cleaned up and they've re-capitalized, there is going to be funding pressure.''

Derivatives trades are showing that while global markets have rebounded since March, the worst may not be over for banks after racking up $387 billion of losses and writedowns from mortgage-related securities since the start of last year. Lehman Brothers Holdings Inc. has tumbled 18 percent in the past 2 days on concern it will require outside funding to shore up its balance sheet.

The three-month Libor-OIS spread traded forward to June 16, the date the June Eurodollar futures contract expires, was 67 basis points yesterday, while the forward spread corresponding to the September Eurodollar expiration was 72 basis points.

The spot three-month dollar Libor-OIS spread was 68 basis points today, after ranging from 24 basis points to 90 basis points this year and peaking last year at 106 basis points in December. The spread averaged 11 basis points for the 10 years prior to August, when the global credit crunch began.

Concern institutions are having difficulty accessing financing increased this week after Standard & Poor's lowered credit ratings for Morgan Stanley, Merrill Lynch & Co. and Lehman Brothers June 2, citing the possibility that the investment banks will have further writedowns on devalued assets.

Lehman Options

Lehman Brothers, the fourth-biggest U.S. securities firm, may report this month its first quarterly loss since going public in 1994, increasing pressure on the company to raise capital, according to analysts at Oppenheimer & Co. and Bank of America Corp. Lehman may be forced either to sell all or part of itself to a bigger financial firm or sell a large quantity of new shares to bolster its finances, the Wall Street Journal reported today.

Options trading shows bearish positions on Lehman exceeded bullish ones by 1.6-to-1 yesterday, a two-month high. The cost of protecting debt sold by Lehman from default rose to 240 basis points from 150 basis points in the credit-default swaps market during the past week, data compiled by UniCredit SpA show.

``Instead of being an immediate bank-liquidity problem, Libor is now being affected by a longer-term capital problem,'' Chowdhury said. The market ``had previously expected the liquidity problems that had boosted the Libor-OIS spread to dissipate relatively quickly.''

Posted by

Editor

at

11:44 AM

View Comments

![]()

Deepening Recession, Tumbling Equity Markets and Sky-High Oil Prices

Housing, Banking, Autos, Airlines, Unemployment, & Oil = Severe Recession

Posted by

Editor

at

8:27 AM

View Comments

![]()

Saturday, June 7, 2008

Thursday, June 5, 2008

Lehman May Raise $5 Billion of Capital

Lehman Brothers Holdings Inc., the fourth-largest U.S. securities firm, may raise as much as $5 billion in capital by early next week, a person with knowledge of the matter said.

Lehman executives are talking to at least one U.S. pension fund and an overseas investor to discuss terms of a transaction, according to the person, who declined to be identified because the negotiations are confidential.

``We are buyers of the stock on the assumption that Chief Executive Officer Dick Fuld will steady the Lehman ship and, with greater stability, the stock will appreciate,'' said Deutsche Bank AG analyst Mike Mayo, who expects Lehman to raise $4 billion of capital and post a second-quarter loss after $2.9 billion of credit-market writedowns.

Lehman fell 26 percent in NYSE trading during the past month, the worst performance in the Amex Securities Broker/Dealer Index, on speculation Fuld will seek outside funding as losses increase.

Sanford C. Bernstein & Co. analyst Brad Hintz reiterated his ``market perform'' rating today on Lehman. While the company won't face ``a life-threatening funding run,'' investors should ``remain on the sidelines until the firm demonstrates a reduction in leverage and lowers its exposures to troubled asset classes,'' he wrote in a report.

Mayo, Moszkowski and Hintz all said Lehman won't collapse like smaller rival Bear Stearns Cos.

``Net-net, we feel that Lehman is not Bear,'' Mayo wrote in a report to clients today. ``Liquidity is not a major issue, in our view, while equity risk remains but does not seem outsized.''

Posted by

Editor

at

8:37 PM

View Comments

![]()

Making Sense of David Einhorn vs. Lehman Brothers

Lehman’s stock plummeted earlier this week in the wake of a Wall Street Journal story saying the firm is “considering” a common stock offering that would be dilutive to shareholders. The precipitous decline was no doubt welcomed by David Einhorn, a hedge fund manager who is short Lehman’s stock and has been quite vocal in his attacks questioning the transparency of the brokerage firm’s financials. Mr. Einhorn’s repeated public slamming of Lehman Brothers reportedly has contributed to the decline in Lehman’s stock price.

Mr. Einhorn has made some extremely damning allegations about Lehman’s accounting practices. He questions some large, unrealized gains Lehman booked in the first quarter that helped goose up the firm’s earnings. The gains were on illiquid securities for which there are no public markets, which means Lehman’s management can assign values at its own discretion. As if that alone isn’t enough of a red flag, Mr. Einhorn also charges that Lehman has given him conflicting explanations of its valuation process. To boot, Mr. Einhorn says Lehman has not properly disclosed or written down various complex debt securities, including $6.5 billion of CDOs. Lehman vehemently denies Mr. Einhorn’s allegations, saying they have “no basis in fact.”

I’m in no position to evaluate Lehman’s earnings statements, and I have no reason to question them. But I also am not quick to accept that Mr. Einhorn’s allegations have no basis in fact. The short seller’s claim that Lehman has placed an artificially high valuation on illiquid securities is eerily familiar. There were similar allegations that Bear Stearns priced artificially high the illiquid assets in its subprime hedge funds before those investment vehicles collapsed. A recent comment by Sy Jacobs, a hedge-fund manager who correctly predicted the subprime mortgage crisis, also cannot be ignored. “Just because we got saved from what would have happened that Monday if Bear went down doesn’t mean we are saved from all the forces that conspired to get Bear Stearns to the brink in the first place,” Mr. Jacobs told Barrons.

I also note a comment by star banking analyst Meredith Whitney about Lehman CFO Erin Callan in the May 17th issue of the Journal: “(Callan) is going out on a limb to provide more transparency in Lehman’s earnings, business and strategy.” On Monday, Ms. Whitney predicted Lehman would report a second quarter loss after earlier predicting a profit. The sudden about face possibly suggests that Lehman’s transparency wasn’t quite as clear as Ms. Whitney originally believed.

The reality is there is so much market turmoil and uncertainty today that it is no longer possible to accurately value many of the assets the major brokerage firms have on their books. As Standard & Poor’s analyst Diane Hinton has noted, “We’re in a market environment where sometimes perception becomes reality.” At the moment, it appears that a short seller on Lehman’s stock appears to have the upper hand in shaping the company’s market perception.

Posted by

Editor

at

8:28 PM

View Comments

![]()

Cramer: Why Own Lehman?

So, the individual asked, would I buy the stock? I said, "Why the heck would I do that? To catch a 2- or 3-point rally? There is no earnings power at Lehman."

I explained that some stocks are neither longs nor shorts -- that, to me, is Lehman. There's no reason to short it, because I don't think it is going under but many are betting that way, and there is no reason to go long it, because the place is set up for a period of big fees from fixed-income products, from structured products, but clients have at last figured out that they will lose their jobs if they keep buying this nonsense.

LEH? I just don't see how they can deliver $5-6 earnings power anymore. Worse, I can't even figure out what they could earn in this environment. The franchise isn't too dicey, just the earnings estimates.

As a former employee of Lehman Brothers, Lars Toomre is sad to see this investment bank go through its current travails. However, he is a bit surprised that the lessons from when he ran the mortgage structured product trading area have not been passed on. Apparently, Dick Fuld, Joe Gregory and others have forgotten that the true price of what an illiquid security or derivative is worth is where you can sell it to an independent third-party. A trader or desk might think that it is worth X. However, if the only other buyer in the market is willing to pay Y, it really is only worth Y and the difference (Y-X) is a loss. Any price above Y is only worth it if one can find another independent buyer.

The faster that Lehman Brothers and the other investment banks liquefy their balance sheets, the quicker the recovery will be in their economic fundamentals. Another item will be to increase their financial transparency. For instance, one item that Toomre Capital Markets LLC would very much like to see is information on the aging of the trading inventory, particularly with regard to the FASB 157 Level 3 assets. Old "aged" inventory that has not been traded in several months is more likely to be further from its actual liquidation value and (absent severe mark-downs that used to occur at some trading firms) is more likely to produce realized losses vis-à-vis the marks. If those aged positions also are in the Level 3 bucket, one has real reason to question just how accurate the market values of those positions are determined. Source

Posted by

Editor

at

8:19 PM

View Comments

![]()

Lehman trading hurt by counterparty worry

NEW YORK (Reuters) - Lehman Brothers Holdings Inc (LEH.N: Quote, Profile, Research) has seen its trading earnings hurt as clients worry about the credit strength of unregulated derivatives units, though it has sufficient capital and access to government funding, a veteran brokerage analyst told clients on Thursday.

But Brad Hintz, who follows brokers for Sanford Bernstein, said that while broker-dealer units in the United States, UK, Japan and Germany "are still being fully accepted by the market, cautious credit officers at clients of the firm are limiting trading with the unregulated derivatives subsidiaries of the company."

Hintz, a former Lehman chief financial officer, reduced his 2008 earnings estimate to $3.20 from $3.42, and his 2009 estimate to $5.95 from $6.11.

"We recommend investors remain on the sidelines with Lehman until the firm demonstrates a reduction in leverage and lowers its exposures to troubled asset classes," Hintz said.

The cost of insuring Lehman Brothers' debt with credit default swaps tightened on Thursday, according to data from Phoenix Partners Group.

Lehman's five-year credit default swaps fell to 240 basis points, or $240,000 a year to protect $10 million of debt, down from 263 basis points at Wednesday's close.

Hintz, in his client note, added that Lehman's fixed income derivative business is under pressure after Standard & Poor's cut Lehman's credit rating to single-A from A-plus.

"Such a downgrade makes it less likely for counterparties to enter into long-dated derivatives," he said, and that will erode profit. Hintz rates Lehman stock "market perform."

Hintz said unregulated subsidiaries that are now "somewhat suspect" include Lehman Brothers Special Financing Inc, Lehman Brothers Finance SA, Lehman Brothers OTC, and Lehman Brothers Commodity Services Inc.

Posted by

Editor

at

10:21 AM

View Comments

![]()

Wednesday, June 4, 2008

Einhorn v. Callan In re: Lehman

For eight months now, Mr. Einhorn, a rabble-rousing hedge fund manager, has pilloried the venerable Lehman Brothers in an effort to drive down the bank’s stock price, which he is betting against.

Lehman Brothers is not amused. In recent weeks, the bank’s chief financial officer, Erin Callan, has tried privately to rebut Mr. Einhorn to nervous investors, who have feared for Lehman’s health ever since Bear Stearns succumbed to a panic. But despite Ms. Callan’s efforts, Lehman’s stock keeps falling: It tumbled 9.5 percent more on Tuesday, in a deluge of selling, bringing its loss for the last 12 months to 59 percent.

The battle over Lehman has captivated Wall Street and left the bank struggling over what to do next. The bank, which is expected to post a quarterly loss of roughly $1 billion in a few weeks, may also raise capital to shore up investor confidence. The bank has sold more than $100 billion in assets in recent months to shore up its finances, according to a person close to the company. That person said new capital would most likely come from a source other than the public markets.

It is impossible to quantify Mr. Einhorn’s influence on Lehman’s stock price. But hours before his speech two weeks ago, trading volume exploded for Lehman stock puts, which are options to sell the stock and profit if its falls. That day, more than 200,000 put contracts against Lehman were sold, up 49 percent from recent typical Lehman put trading.

Lehman, like its counterparts, is racing to use less leverage. The bank had a gross leverage ratio of 31.7:1 at the end of the first quarter, meaning it had borrowed $31.70 for each dollar of equity. Lehman has whittled that ratio down to 25:1 through its more than $100 billion in asset sales, said the person close to the company who was given anonymity because he was discussing a pending financial filing. A small amount of the sales were to two hedge funds set up by former Lehman executives.

Posted by

Editor

at

1:57 PM

View Comments

![]()

Lehman on the block?

Lehman Brothers (LEH) may not be independent for long. The Wall Street Journal reports the investment bank may be forced by its balance sheet woes and the recent plunge of its stock to sell part of even all of itself to another financial firm. Lehman shares sold off Tuesday after the Journal reported Lehman was considering a $4 billion sale of stock. But the newspaper says the selloff in Lehman shares, which knocked 10% off the company’s market value Tuesday, might make a plain stock sale more difficult for shareholders to stomach. And the company may need the cash to forestall another ratings downgrade that could force it to post more collateral on derivatives positions.

Lehman shares were down as much as 15% in trading Tuesday afternoon before the firm publicly denied it had been forced to borrow from the Federal Reserve. The Journal reports Lehman engineered part of its Tuesday afternoon relief rally by buying back its own shares - an unusual move given the worries about the firm’s financial health and the company’s recent efforts to bring down its leverage ratios. Though the buyback could be taken as a sign of management’s confidence that Lehman can weather the storm, others see it as smacking of desperation. Wednesday’s action may go a ways toward determining whether Lehman is able to stay the course or whether it ends up doing a deal with the likes of Citadel or Blackstone (BX).

Posted by

Editor

at

7:14 AM

View Comments

![]()

Tuesday, June 3, 2008

Lehman on the Ropes, Nevertheless Buys Shares Back

This is one of the most irresponsible financial actions I have seen in quite a while.

For a firm which is overlevered, rumored to be on the heels of Bear Stearns, with a large short interest, to go out and buy its own shares? This is a ludicrous short-sighted use of scarce funds. How could it need to sell shares last night, and per the Wall Street Journal story [tonight] "Lehman is Seeking Overseas Capital", still be looking for new equity, yet simultaneously be buying back its stock? Oh, but wait, Lehman says it has plenty of liquidity for this exercise. Remember, Bear thought it had plenty of cash until the run started.

The Wall Street Journal story also indicates that the article it ran last night that the investment bank would sell new shares (which had the earmarks of being a leak timed to bolster the stock) has been scuttled due to the 15% fall in price today (which was clawed back to 10% by virtue of the purchases). The new story is that Lehman is in talks with "a group of investors". The objective clearly is to get a higher price than the public markets now offer, but pray, why would anyone sign up for that? Lehman had better stitch up something quickly, because without new capital, its days are numbered. Its only hope is that pressure is applied behind the scenes by the powers that be for someone to step forward. But with financial institutions around the world under stress, and the few unaffected players (sovereign wealth funds, Japanese banks) cool on US banks, it will take quite a lot of arm twisting to get a transaction in place.

Lehman now has the look of a company that is desperate, groping for options, and hoping that its purchases might punish shorts. It's highly unlikely that the firm can win that game (remember the wisdom of that old Wall Street saying, "Don't fight the tape"). But note that the Journal blandly says that Lehman can borrow from the Fed to buy its own shares. Is this what the TSLF was intended to do? Lehman has had to deny using that facility to shore up confidence; it isn't clear that accessing it is an option.

And note while buying shares at below book value will normally improve the cosmetics of a balance sheet, it doesn't work with a highly geared enterprise. Shrinking the equity base makes all the leverage ratios worse. And the idea that Lehman's shares are a buy at these levels presupposed that its published finacials present an accurate picture. But does anyone believe them? As we noted in an earlier post, their marks on CMBS and leveraged loans at the end of first quarter were simply not credible, nor was their claim that servicing rights were an effective hedge to Alt-A exposures. Lehman also increased its Level 3 assets from year end to the end of the first quarter, made inconsistent statements between its 10-Q and related conference call, and those Level 3 assets are roughly 2.4 times common equity.

Posted by

Editor

at

8:34 PM

View Comments

![]()

Lehman Counterparty Rumor or Reality?

We don't "do" rumors in the 'Ville but we'd be remiss if we didn't pass along our ears to ye faithful.

The chatta--and it's just that, unconfirmed chatta--is that counter-parties are "pulling a Bear" on Lehman Brothers (LEH). In other words, the "rumor becomes reality" scenario is making it's way around the trading wires.

Posted by

Editor

at

4:10 PM

View Comments

![]()

Lehman Says Cash Holdings Rise As Rumors Swirl

Lehman Brothers Holdings (LEH) shares closed down nearly 10% Tuesday as investors worried about dilution from a potential capital increase, and as the firm disputed rumors that it had borrowed from the Federal Reserve.

Investors' concerns about Lehman's liquidity and ability to fund its operations were so great that Lehman issued a statement Tuesday afternoon denying rumors it was forced to borrow money from the federal government to support its business operations.

"We did not access the primary dealer facility (Fed Window) today," said company treasurer Paolo Tonucci, breaking a "quiet period" in the weeks between the end of the fiscal second quarter on May 30 and the actual reporting of results in mid-June. "The last time we accessed the facility was on April 16 for testing purposes."

Prior to the statement, Lehman's shares skidded as much as 14.6% to $28.90 following a report in The Wall Street Journal that the company is likely to report a loss in its fiscal second quarter and shore up its capital by raising between $3 billion and $4 billion of new equity. Shares closed Tuesday down $ 3.22, or 9.5%, to $30.61. In recent late trading shares are down to $30.50.

Investors who have seen Lehman's shares decline 58% in the past 12 months would not welcome further dilution. But their distaste must be balanced against the company's need for capital following billions of dollars of credit-related writeoffs in recent months.

Lehman's denial of liquidity problems echoed the situation a few months ago, when the smallest of the four big investment banks fought off similar rumors in the wake of problems at Bear Stearns Cos. Bear Stearns, now owned by JPMorgan Chase (JPM), nearly collapsed when customers fled and financing dried up over fears about its ability to fund its daily operations.

Lehman on Tuesday said that its pool of available cash has actually increased in recent months. "We ended the first quarter with liquidity of $34 billion, and finished the second quarter well above $40 billion," Paolucci said in a prepared statement.

On Monday, Lehman's debt was downgraded by Standard & Poor's Rating Services, a move that could prove costly to the firm. The downgrade may explain why the investment bank may have to raise as much as $4 billion of new equity, analysts said on Tuesday.

By Lehman's own calculations, under derivatives industry rules it could be forced by counterparties to post $200 million of additional collateral on its trading positions once its debt was cut one notch - and $5.4 billion more if its rating falls another notch. On Monday, Standard & Poor's Ratings Services lowered its long-term rating on Lehman to A from A+, and kept it on negative outlook to signal that more could come.

The calculations on collateral were given in the company's first-quarter 2008 filing with the Securities and Exchange Commission, and may have changed since the positions were stated as of Feb. 29, 2008. Moreover, Lehman has said it calculates the contingent collateral as part of its liquidity planning. It also may have collected its own cash collateral from other broker-dealers since S&P also cut the ratings of Merrill Lynch (MER) and Morgan Stanley (MS) by a notch on Monday.

Even without the rating action, however, the costs of Lehman's heavy derivatives exposure is high. As of Feb. 29, its trading partners could have demanded $4.3 billion of collateral from the company, according to its filing.

The rating downgrade and its consequences could represent a lot of lost capital for Lehman, particularly when it and rivals were already struggling to reduce leverage by raising equity and shedding assets. The cash posted to support its derivative positions would have to come from a unit that does not have the preferred borrowing privileges that the Federal Reserve Board recently gave to Lehman and other big investment banks.

"As a result of this significant potential burden, we would not be surprised if Lehman raises additional capital to be prudent and improve the changes that it avoids another rating downgrade," Sanford Bernstein analyst Brad Hintz wrote in a note to investors on Tuesday.

Hintz, a former chief financial officer at Lehman, lowered his second-quarter earnings estimates for Lehman to 15 cents a share from $1.38 last week after the firm said it suffered losses on hedge positions.

Posted by

Editor

at

4:07 PM

View Comments

![]()

Monday, June 2, 2008

Lehman Cut from A+ to A by S&P

Morgan Stanley, Merrill Lynch & Co. and Lehman Brothers Holdings Inc. plummeted in New York trading after Standard & Poor's lowered credit ratings for the investment banks, saying they may have to book more writedowns on devalued assets.

Morgan Stanley, the second-biggest U.S. securities firm by market value, was cut to A+ from AA-, S&P said today in a report. Merrill Lynch, the third-biggest, was cut to A from A+, as was Lehman Brothers, the fourth-biggest. Goldman Sachs Group Inc., the largest of the group, was affirmed at AA-. The outlook on all four New York-based companies remains negative, S&P said.

The ``actions reflect prospects of continued weakness in the investment banking business and the potential for more write-offs, though not of the magnitude of those of the past few quarters,'' Tanya Azarchs, an S&P analyst, said today in a statement.

The ratings downgrades may make it harder for the banks to sell derivatives such as credit-default swaps that are tied to bonds or loans, said Brad Hintz, an analyst at Sanford C. Bernstein in New York. Single-A rated firms are less desirable as trading counterparties for fixed-income derivatives that extend longer than five years, he said.

The firms are also likely to have to post more collateral on the trades they've already made with other parties, raising their costs, Hintz said.

Posted by

Editor

at

3:08 PM

View Comments

![]()

Sunday, June 1, 2008

REO Keeps Rising

Lenders and investors in mortgages owned about 660,000 foreclosed homes in April, up from 493,000 in January and 231,000 in January 2007, according to First American CoreLogic ... The April total works out to about 1 in 7 previously occupied homes available for sale nationwide (4.55 million).

The lenders were slow to reduce prices at first, apparently hoping for "better market conditions". Now some lenders are getting aggressive as they realize that holding REOs means even greater losses as prices continue to fall.

From anecdotal evidence, it appears the lenders are being aggressive on pricing at the low end, but are still reluctant to discount mid to higher priced homes. This will probably change as the REOs continue to pile up at the banks. Source

Posted by

Editor

at

6:57 PM

View Comments

![]()